Apparel & Textile Machinery

(75900)

Building Material Machinery

(55852)

Cleaning Equipment

(104054)

Electronics Production Machinery

(39881)

Energy & Mineral Equipment

(127869)

Engineering & Construction Machinery

(401378)

Environmental Machinery

(35590)

Food & Beverage Machinery

(97353)

Industrial Compressors & Parts

(28499)

Industrial Robots

(3603)

Industry Laser Equipment

(44115)

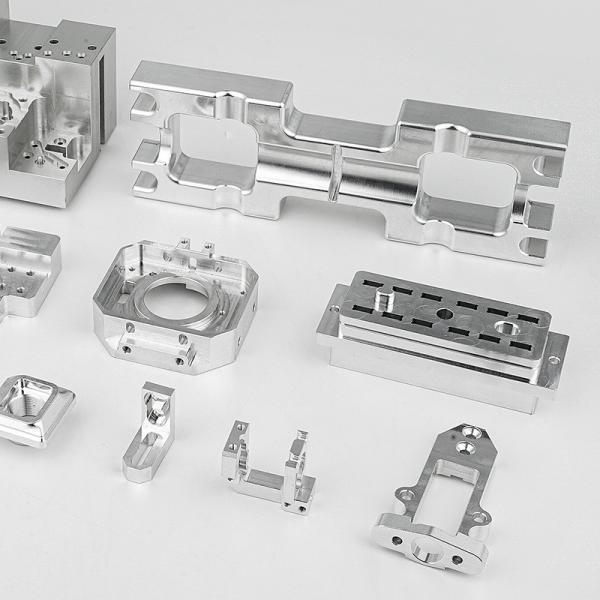

Machine Tool Equipment

(129643)

Machinery Accessories

(202994)

Machinery Service

(996)

Metal & Metallurgy Machinery

(69132)

Packaging Machine

(102444)

Paper Production Machinery

(29371)

Language

Français

Русский язык

Español

日本語

Português

Show all machinery categories

Apparel & Textile Machinery

(75900)

Building Material Machinery

(55852)

Cleaning Equipment

(104054)

Electronics Production Machinery

(39881)

Energy & Mineral Equipment

(127869)

Engineering & Construction Machinery

(401378)

Environmental Machinery

(35590)

Food & Beverage Machinery

(97353)

Industrial Compressors & Parts

(28499)

Industrial Robots

(3603)

Industry Laser Equipment

(44115)

Machine Tool Equipment

(129643)

Machinery Accessories

(202994)

Machinery Service

(996)

Metal & Metallurgy Machinery

(69132)

Packaging Machine

(102444)

Paper Production Machinery

(29371)